It’s Thursday!

Hello, Curse and Coffee friends,

Today, we look at Google’s AI infra bet.

Hit reply and let us know what you think (we read all of your kind words).

Coffee at the ready…

The Big Sip

Google CEO Sundar Pichai

The take: Sundar Pichai is selling the same AI spending he called irrational three months ago — and using 19th-century infrastructure as the receipt.

What happened: At the India AI Impact Summit on 18 February, Pichai compared Alphabet's record $175–185 billion 2026 capital spending plan to the US railroad and highway buildouts.

Why it matters: That figure doubles last year's spend, and some analysts now expect Alphabet's free cash flow to crater 90% in a single year.

What to watch: Whether the $240 billion Google Cloud backlog converts to real revenue before the next earnings call in late April.

Railroads also bankrupted 89 of America's 364 rail companies in a single panic. Someone get Pichai a history book that includes Chapter 2.

[Analysis] Bank of America Global Fund Manager Survey, 17 Feb 2026

Background: Bank of America (BofA) polled 190 fund managers overseeing $512 billion between 6 and 12 February.

The quote: Chief Investment Strategist Michael Hartnett flagged that a record 35% of managers now say corporations are "overinvesting." That's the highest reading in 20 years. Another 25% named an AI bubble the top tail risk to markets.

Timing: Pichai's railroad pitch in Delhi landed one day after this survey dropped. The trip was planned weeks ahead. But the optics aren't: he's defending the biggest corporate spending bet in history, the day after Wall Street's loudest scepticism signal.

Sponsor Break

Before we slurp into today’s brew…

Here are some wordies from today’s sponsor.

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

Here’s Your Brew

In November, Pichai told the BBC the AI boom had "elements of irrationality" and warned no company was immune.

Three months later, he's in Delhi, comparing the same spending to the Eisenhower Highway System.

To be fair, his position has always been "the tech is transformative, but the cycle carries risk."

What shifted isn't the stance.

It's the emphasis, and the stage he chose to deliver it from.

Delhi wasn't a neutral venue. Pichai used the trip to announce a $15 billion AI hub in Vizag — built with Adani and Airtel — plus new subsea cables and training programmes.

That's a $185 billion global spend pitched from a country where Google wants to look like an infrastructure partner.

Not a company under earnings pressure.

Cloud backlog doubled year-on-year.

Q4 revenue?

Up 48%. And Gemini just crossed 750 million users. None of that is fake.

But the spending guidance blew past Wall Street's $119.5 billion estimate by over $60 billion.

Alphabet issued $20 billion in bonds to cover the difference. Nobody's arguing that foundational infrastructure doesn't pay off in the long run.

Pichai knows that better than most.

What he left out of the Delhi pitch is that the 1870s railroad investors got wiped out before the freight arrived.

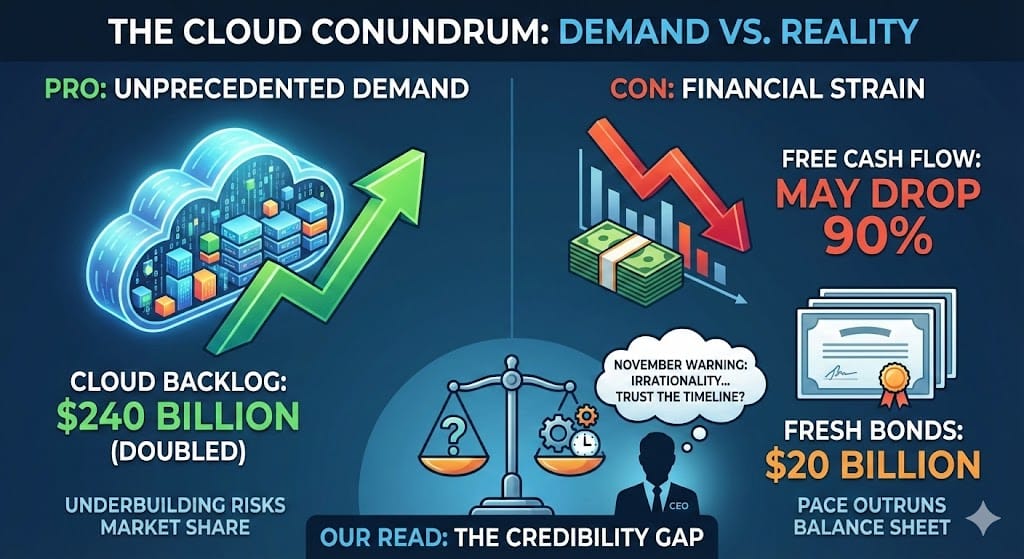

Two Sides, One Mug

The Cloud Conundrum

Pro: Cloud backlog doubled to $240 billion — that's demand, and underbuilding now hands the market to competitors.

Con: Free cash flow may drop 90% in one year, and the funding structure — $20 billion in fresh bonds — suggests the pace is outrunning the balance sheet.

Our read: Nobody disputes that the tech works. The question is whether the CEO who warned of irrationality in November should be the one asking you to trust the timeline.

Receipt of the Day

Record 35% of managers say corporations are overinvesting. Cash levels at 3.4% — a level that has preceded market drops every time it's appeared in the last 20 years. The clearest snapshot of where institutional money thinks this boom is heading. (Note: the full BofA survey is paywalled; this is the best available public summary.)

Spit Take

$650 billion: four companies' 2026 AI spending. More than Belgium's entire economic output. — BofA FMS / company filings

Your Coffee Break Links (and water cooler chatter)

Alphabet shares fall as $20B bond sale ignites capex concerns — Century bonds to fund AI. Yes, really. [Report]

Pichai outlines Google's India AI hub and subsea cable push — $15 billion Vizag data centre plus new undersea cables. The geopolitics are as loud as the spend. [Report]

India AI Summit: subsidised GPUs at ₹65/hour — India is pricing GPU access at a quarter of the global rate. That changes who builds what. [Analysis]

Mugshot Poll 📊

Pichai compared AI spending to railroads. What's the better historical analogy?

You can read all our back issue newsletters for free here.

For the love of coffee, see you tomorrow!

Enjoy your Thursday, keep it caffeinated.

How did we do?

Thanks for reading!

Are you subscribing?

Join your crew of caffeinated sceptics today.

Be sure to get your daily Curse and Coffee fix by hitting the button below.

Open Monday to Friday.

Read yesterdays newsletter about Elon Musk’s off switch here.

Elon Musk

Get Your Free Curse and Coffee Receipts Toolkit

Learn how to read any government/company PDF without crying!

Take advantage of what others miss. We teach you how to extract the gems from the dirt.

Share the Curse and Coffee newsletter with just 1 real person to download your Receipts Toolkit instantly. A field guide for caffeinated sceptics who want to pull signal from filings, datasets, and reports.

No law degree needed. A no-nap promise.

Refer to unlock and never struggle to identify opportunities in long, drawn-out documents again.

“Receipts over vibes. Always.”

Thank you for sharing…

And be sure to use your toolkit to extract max alpha from any document you read.

Stay Caffinated!